child care tax credit 2020

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. On your tax return you will be able to claim a credit for half of your childcare expenses totaling a refundable credit of 7000.

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

For this tax filing period only the American Rescue Plan from March 2021 increased the Child and Dependent Care Tax Credit to 8000 from 3000 for a family with one child and to 16000 for two or more children from 6000.

. Complete IRS Tax Forms Online or Print Government Tax Documents. Prep save and e-file. For 2020 the credit was a maximum of 2000 only for children aged 16 or less as of 12312020 with a phase-out at higher income.

However you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021. Most camps shut down or dramatically pared back operations and parents added teacher and. This phaseout will not reduce your credit below 2000 per.

Complete IRS Tax Forms Online or Print Government Tax Documents. The Child Tax Credit is the credit for having a qualifying child dependent. For two or more qualifying individuals the maximum credit is 6000 times 35 or 2100.

So the maximum credit available to a person who pays care expenses for one qualifying individual is 3000 times 35 or 1050. Everyone else with income of 200000 or less. Free help with preparing and filing taxes.

25 State Filing. Generally you may not take this credit if your filing status is married filing separately. Helpful guidance and explanations so you can file accurately.

You qualify for the child care tax credit as long as you. Your Adjusted Gross Income AGI determines how much you can claim back. Married couples filing a joint return with income of 400000 or less.

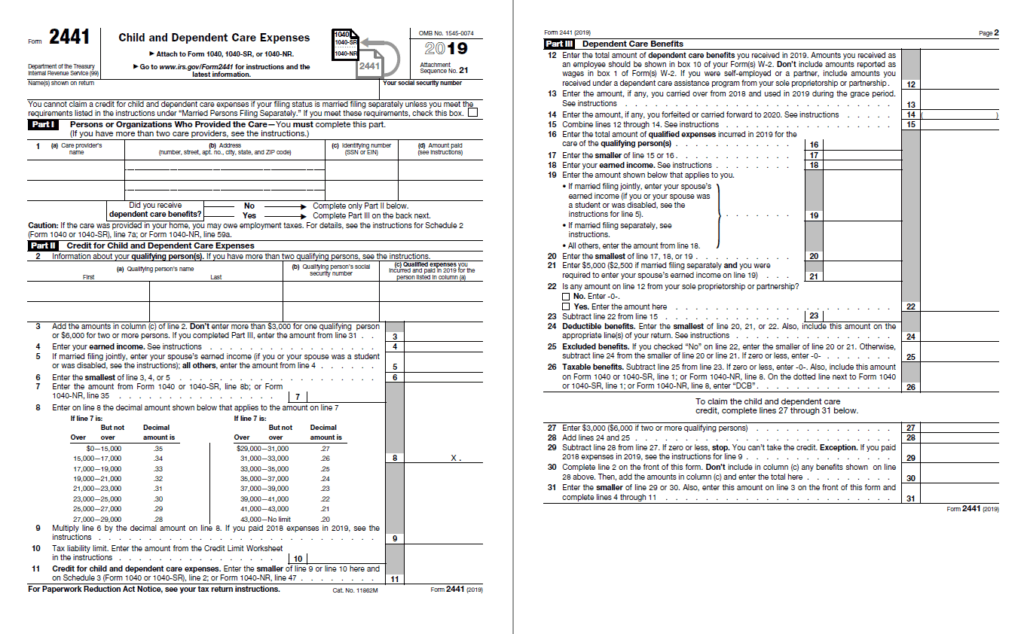

You and your spouse file a joint return including your one dependent child. In tax year 2020 the amount of qualified expenses that could be used to calculate the credit was up to 3000 for one qualified childdependent or up to 6000 for multiple childrendependents. Also for tax year 2021 the maximum amount that can be contributed to a dependent care flexible spending account and the amount of tax-free employer-provided dependent care benefits is increased from 5000 to 10500.

Arent filing separate returns if youre married. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. All the goods you get with Classic plus.

Changes for the Child and Dependent Care Tax Credit Qualified expenses. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. For 2021 the credit is a maximum of 3000 per child who is aged 17 or less on 12312021 with a phase out at higher income.

Information on tax credit programs you may be eligible for such as Earned Income Tax Credits New York State Noncustodial Parent Earned Income Tax Credit Child Tax Credits and Child and Dependent Care Tax Credits. See Form DTF-216 for recordkeeping suggestions for child care expenses. This credit is equal to 25 of the federal credit for child and dependent care expenses.

Who qualifies for the Child and Dependent Care Credit. IT-216 Fill-in IT-216-I Instructions Claim for Child and Dependent Care Credit. Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth.

See Form DTF-215 for recordkeeping suggestions for self-employed persons claiming the earned income credit. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100. It is a partially refundable tax credit if you had earned income of at least 2500.

The new advance Child Tax Credit is based on your previously filed tax return. 1200 in April 2020 600 in December 2020January 2021 1400 in March 2021. This goes up to 1000 every 3 months if a child is.

There are also maximum amounts you must consider. You can calculate your credit here. The child care tax credit was lower in previous years.

The amount of credit gradually decreases based on your household income. Parents with one child can claim. Last March parents were frantically searching for day camps to enroll their kiddos once school let out for the summer.

The Child Tax Credit incidentally is worth as much as 3600 for dependents under six and 3000 for dependents over six and under 17. For 2021 this increases to 8000 for one and 16000 for multiple dependents. Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021.

Ad File a free federal return now to claim your child tax credit. Advance Child Tax Credit Find COVID-19 Vaccine Locations With Vaccinesgov COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Tax Year 2021 Tax Year 2020 Tax Year 2019 Tax Year 2018.

The child care tax credit is a good claim on 2020 taxes even better for 2021 returns Thursday March 11 2021. Your total credit per child can be reduced by 50 for each 1000 or a fraction thereof. The percentage starts to decrease once your AGI goes over 15000 but it doesnt phase out entirely.

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work. Calculating How Much the Credit is Worth to You The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. The credit doubles if the expenses are related to a quality child care provider.

If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. You may qualify to e-file your income tax return for free.

Advance CTC payments are half of the credit with the other half available for claiming when taxpayers file. Tax-Free Childcare You can get up to 500 every 3 months up to 2000 a year for each of your children to help with the costs of childcare. Tax software you can log in to and use anywhere.

6000 per child under the age of seven plus a topup of up to 1200 for 2021 3750 per child between the ages of seven and 16 plus a topup of up to 750 for 2021 8250 per child with a severe disability plus a topup of up to 1650 for 2021. Access to Priority Support via. The Child Tax Credit will help all families succeed.

Households with an income of less than. Or Up to 8000 for two or more qualifying people who need care up from 2100 before 2021. For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000.

The beginning of the reduction of the credit is increased from 15000 to 125000 of adjusted gross income AGI. 5218 More information from DHHS. This credit is also refundable up to 500.

These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. In 2020 the credit was worth up to 3000 for one dependent and 6000 for two or more dependents. Families with a single parent also called Head of Household with income of 200000 or less.

You make a combined income of 120000 under the threshold and pay 9000 in childcare expenses so you can work. IT-215-I Instructions Claim for Earned Income Credit.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Dependent Care Benefits Overview Criteria Types

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

What Are Marriage Penalties And Bonuses Tax Policy Center

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Schedule 8812 What Is Irs Form Schedule 8812 Filing Instructions